Electronic Tax Solutions

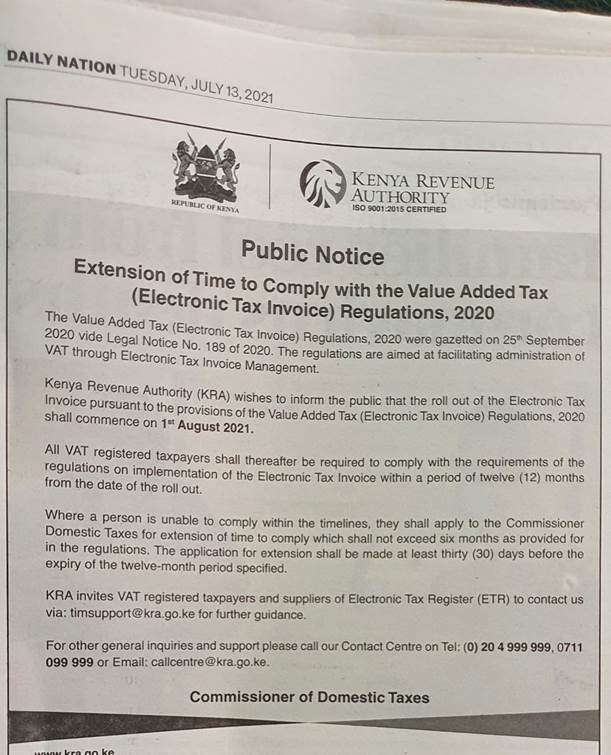

On 25 September 2020, the Cabinet Secretary of National Treasury and Planning gazetted the Value Added Tax (Electronic Tax Invoices) Regulations, 2020 under the Value Added Tax Act. The changes published require significant changes to current technology (Electronic Tax Registers) within 12 months of the gazettement. These new requirements are comprehensively addressed by Sight and Sound Computers Limited’s offering.

Highlights of key technology changes currently being operationalized by the Authority:

- Register Specification: Capable of interconnectivity with information technology networks

- integrating with the Authority’s systems;

- transmitting or connecting to a device that will transmit the recorded data to the systems

- Transmitting to the Authority’s system the tax invoice data and the

end of day summary of the respective day’s data - Users obligations in the Act

- Notify commissioner of inability to use register within 24hrs (this is currently 48hrs)

- Ensure devices shall be regularly serviced and a record of service is maintained

- The device should be capable of allowing updates for any changes in the tax laws

- Devices shall generate a Quick Response (QR) Code

- Updated device security specifications

Background: Main Register Types & Regulation Impact

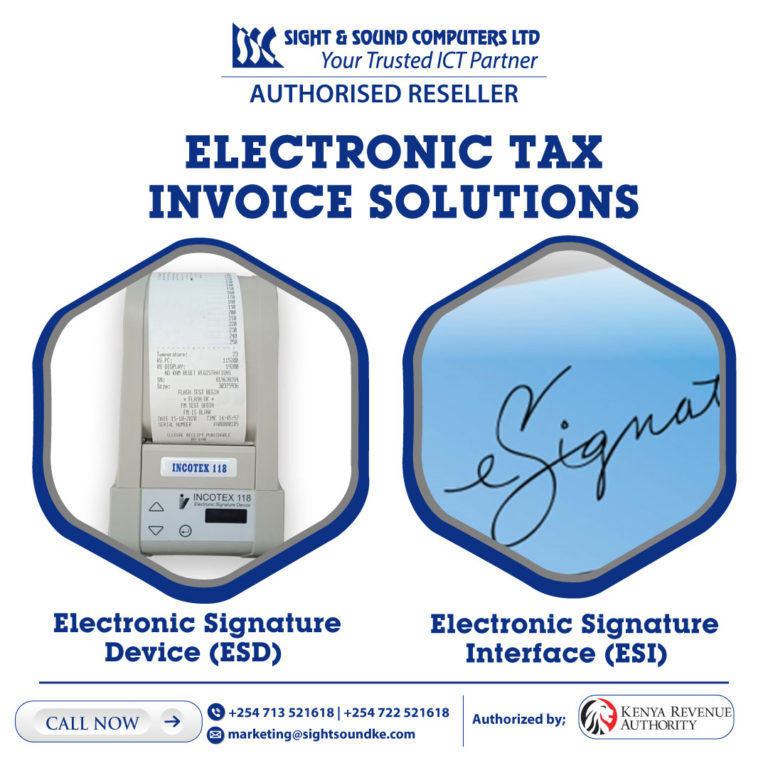

Electronic Signature Devices (ESD)

These devices “sign” invoices already generated by Software Systems (e.g. Accounting Software, ERPs). Under current regulation the devices do not capture any data and cannot generate “Z Reports”. The regulation now requires these devices to be connected online, capture Invoice + VAT Amounts and send this data to the Authority’s systems daily.

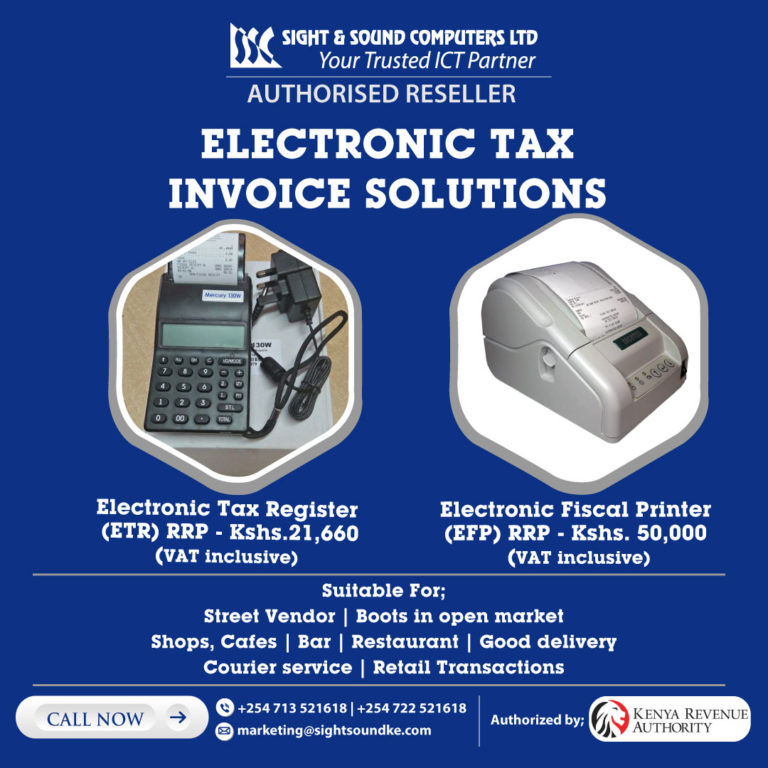

Fiscal Printer

These devices generate tax invoices from data sent to them via software (mainly Point of Sale Systems). The data included invoice + VAT amounts which are stored on the device. New regulations require the devices to be connected online in order to send this data to the Authority’s systems daily.

Sight and Sound Computers Limited Offering

Sight and Sound Computers Limited has been appointed as an authorized value-added reseller for KRA approved distributor Pergamon Limited.

Sight and Sound Computers Limited is ready to supply KRA Approved Electronic Signature Devices (ESD), Fiscal Printers, and Electronic Tax Registers (ETR) that are fully compliant with the new regulations.

There are a variety of models available that address various customer use cases including mobile field sales and multi-site requirements.

Sight and Sound Computers Limited also provides the following services needed to ensure that the rollout of fiscal devices is successful:

- Installation and configuration: Proper set up to ensure compliance with authority guidelines

- Staff Training: Ensuring correct use as per KRA guidance

- Annual Maintenance Contracts: Servicing must be done as per authority regulations